Becoming a millionaire isn’t about flashy cars, viral TikTok strategies, or overnight success.

It’s about consistency, discipline, and—brace yourself—boring habits.

I know that doesn’t sound exciting, but here’s the kicker: the very habits that seem mundane are the ones that most people overlook, and that’s exactly why 98% of people will never reach true financial freedom.

If you’re part of the 2% who are ready to build real wealth, this post is for you.

These five habits took me from a net worth of $400,000 in 2020 to over $1.3 million in just a few years.

They aren’t glamorous, but they work. Let’s break them down step by step.

1. Track Your Net Worth Monthly

Think about this: if you don’t know where you stand financially, how can you know where you’re going?

Tracking your net worth isn’t just about numbers—it’s about building awareness.

Every month, I dedicate about an hour to updating a simple spreadsheet that tracks:

- Assets: Cash, investments, real estate, vehicles (depreciated value), and any other items of value.

- Liabilities: Mortgages, car loans, credit card balances, student loans, etc.

- Net Worth: Assets minus liabilities.

Why This Matters

When I first started tracking my net worth, it was like shining a flashlight in a dark room—I finally saw the full picture.

Back in 2020, my net worth was $400,000.

Today, it’s $1.3 million, and this habit has been instrumental in that growth.

Why? Because what gets measured gets managed.

Tracking your net worth forces you to be intentional about building wealth and curbing debt.

How to Get Started

- Use simple tools like Google Sheets, Excel, or apps like Personal Capital or Mint.

- Create a monthly reminder to update your numbers.

- Break it into categories: cash, investments, debts, and liabilities.

Tip: Don’t get discouraged if your net worth grows slowly at first. Progress compounds over time, and seeing small wins will keep you motivated.

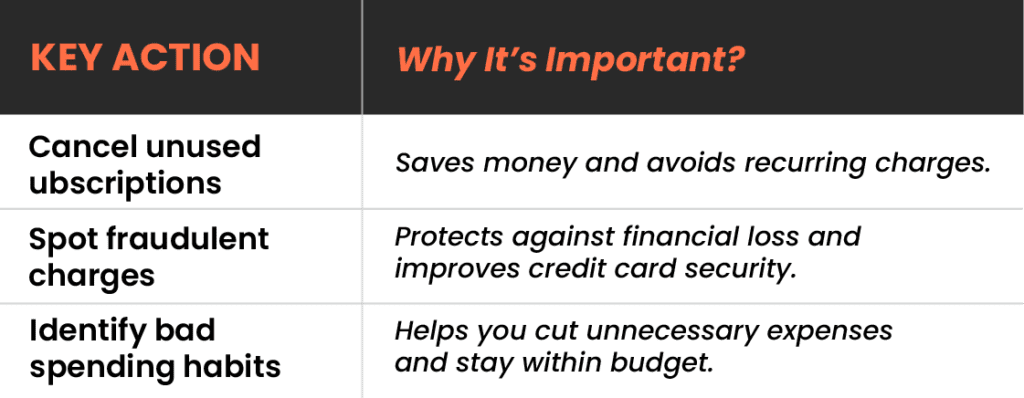

2. Review Credit Card and Bank Statements Line by Line

I’ll admit, this is tedious, but it’s also one of the most effective habits for plugging financial leaks.

Every month, I sit down and go through my credit card and bank statements. I’m looking for:

- Unnecessary Subscriptions: Are you paying for a streaming service you haven’t used in months?

- Errors or Fraudulent Charges: Mistakes happen, and fraud is more common than you think.

- Spending Patterns: Where is my money actually going? Are there areas I need to cut back?

Why This Matters

If you’re not paying attention to your money, you’re giving it away.

Small leaks—like forgotten subscriptions or unnecessary fees—add up over time.

Canceling a few $10 charges might not feel like much, but over a year, that’s hundreds of dollars that can be reinvested.

How I Simplify This

- Automate Reports: Many banks and credit card companies let you download monthly statements in a CSV format for easy review.

- Categorize Spending: Use tools like YNAB (You Need A Budget) to organize your spending by category.

- Set Alerts: Many apps, including bank apps, allow you to set alerts for unusual activity.

3. Track Business Income and Expenses Religiously

As an Amazon seller (or any business owner), this step is crucial.

I’ve coached hundreds of sellers, and one common theme among struggling businesses is a lack of financial clarity.

Many people are so focused on sales volume and revenue that they neglect profitability.

Here’s what I track every month:

- Income: Revenue from all sources, including sales and side hustles.

- Expenses: Shipping, storage fees, advertising, payroll, software tools, and subscriptions.

- KPIs (Key Performance Indicators): Metrics like refund rates, ROI on ads, and profit margins.

Why This Matters

You could be making $100,000 in sales but only keeping $5,000 after expenses.

Without tracking, it’s impossible to know whether your business is thriving or bleeding cash.

Tools to Simplify the Process

- QuickBooks: Ideal for small businesses.

- Inventory Lab: Specifically designed for Amazon sellers to track profitability.

- Excel Spreadsheets: A low-cost option for tracking income and expenses manually.

Common Mistakes to Avoid:

- Ignoring refund rates: Returns can quietly drain your profits.

- Focusing solely on sales volume: Profit margins matter more than revenue.

- Neglecting operational costs: Hidden costs like long-term storage fees can pile up.

4. Track Personal Expenses Every Month

You’ve probably heard the saying, “It’s not what you make, it’s what you keep.”

This couldn’t be more true.

Many people make good money but spend it just as fast—if not faster.

Lifestyle inflation (the tendency to increase spending as income rises) is a wealth killer.

My Monthly Process:

- Categorize Expenses: Housing, food, entertainment, transportation, and “fun” money.

- Set Spending Limits: Allocate a percentage of income to each category. For example, I aim to save 20-30% of my income.

- Review Monthly Trends: Compare spending from one month to the next and look for patterns.

Pro Tip: Treat savings as a fixed expense, not an afterthought. Automate transfers to a high-yield savings account or investment portfolio every payday.

The Reality Check

Tracking expenses isn’t about being miserly.

It’s about aligning spending with your priorities.

For example, if your goal is financial freedom, buying a new car every two years or upgrading to a bigger house may not align with that vision.

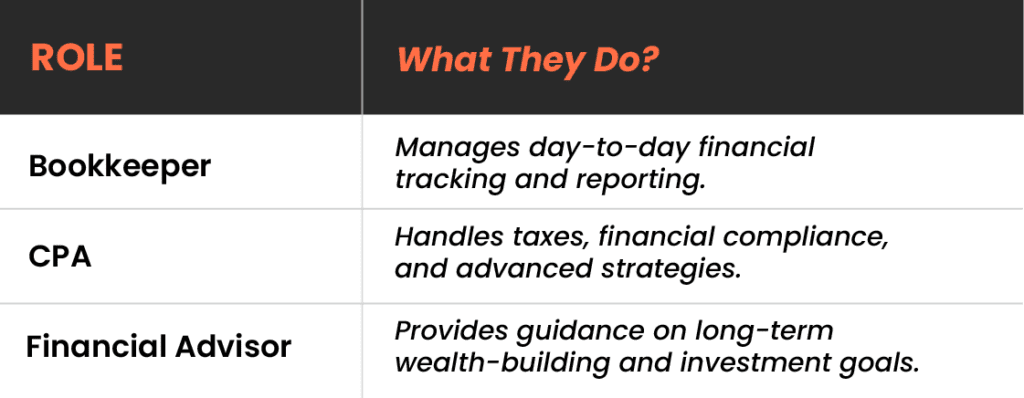

5. Invest in People to Help You

Building wealth doesn’t mean doing everything yourself.

As your income grows, your time becomes more valuable, and delegating tasks is one of the smartest investments you can make.

My Financial Support Team:

- Bookkeepers: My bookkeeper in the Philippines charges $10/hour and handles monthly reports, freeing up hours of my time.

- CPA (Certified Public Accountant): Ensures compliance and minimizes tax liabilities.

- Financial Advisor: Helps with long-term planning, investments, and tax-efficient strategies.

How to Start

If you’re on a tight budget, consider starting small.

Virtual assistants (VAs) from platforms like Upwork or Fiverr can handle basic tasks like data entry or bookkeeping for as little as $5-$10/hour.

As your financial situation improves, you can scale up to more specialized professionals like CPAs or financial advisors.

Final Thoughts: Crawl Before You Run

Building wealth isn’t about luck or secret strategies—it’s about consistently practicing the habits that most people ignore.

The flashy stuff may grab attention, but it’s the “boring” work that builds the foundation for long-term success.

Quick Recap: The 5 Habits

- Track your net worth monthly.

- Review credit card and bank statements line by line.

- Track business income and expenses.

- Track personal expenses every month.

- Invest in people to help you.

If you’re serious about building wealth, start with these habits today.

They may not be exciting, but they’re effective.

Remember, it’s not about getting rich quick—it’s about getting rich for good.